Chinese economy faltering as Don’s Party rolls on…

News that a Chinese trade delegation had cancelled this week’s planned visit to farms in the states of Montana and…

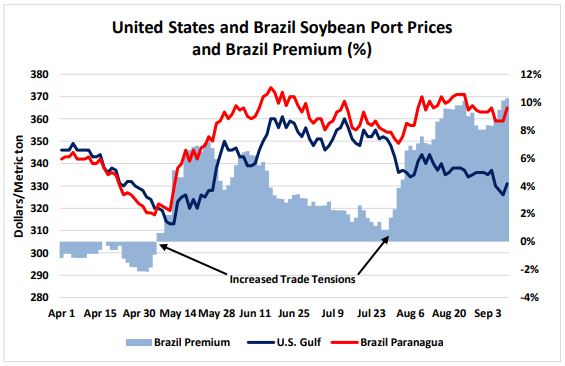

US-China trade war is now a love fest…

World grain markets trod water early last week ahead of Thursday’s release of the October World Agricultural Supply and Demand…

Australia losing relevance as a global wheat exporter…

The Australian Bureau of Statistics released their July export data last week and the grain numbers undoubtedly reflect the effects…

The small Australia crop is quickly getting smaller…

Last year’s Australian winter crop production was the lowest in more than a decade after drought in the eastern states…

Mixed fortunes for Canadian farmers…

The first official Canadian crop estimates for the 2019/20 crop year were released last Wednesday by Statistics Canada, the national…