With less than 1% of our clients’ grain remaining unsold, our 2024 season results are now finalised — and we’re proud of the strong outcomes we’ve achieved across all major commodities.

We’re now inviting growers to confidentially benchmark their grain marketing results against our client averages. It’s a great way to see how your returns compare and uncover opportunities to improve your strategy ahead of next season.

If you’re interested, simply call our office on 1300 946 544 to speak with your local broker, or fill in the following form — where you can also select your preferred call-back time. We’ll do the rest.

🌾Wheat Market Update – Key Insights & Actionable Advice

As we move through the critical stages of the global wheat season, there are a few key developments to keep on your radar — especially if you’re managing harvest cashflow or still holding unsold grain.

- Argentina’s wheat crop is showing strong promise, with 95% now rated in excellent condition, thanks to improved soil moisture.

- Canada, however, is facing challenges and is now expected to produce below the anticipated 35 MMT, which could tighten supply in the months ahead.

- After a brief rally sparked by Northern Hemisphere harvest delays, wheat prices have dropped 3% this week. Recent widespread rainfall has improved growing conditions, adding to the bearish short-term outlook.

💡What does this mean for you?

🌾 Barley Market Update – Key Drivers & Smart Selling Strategy

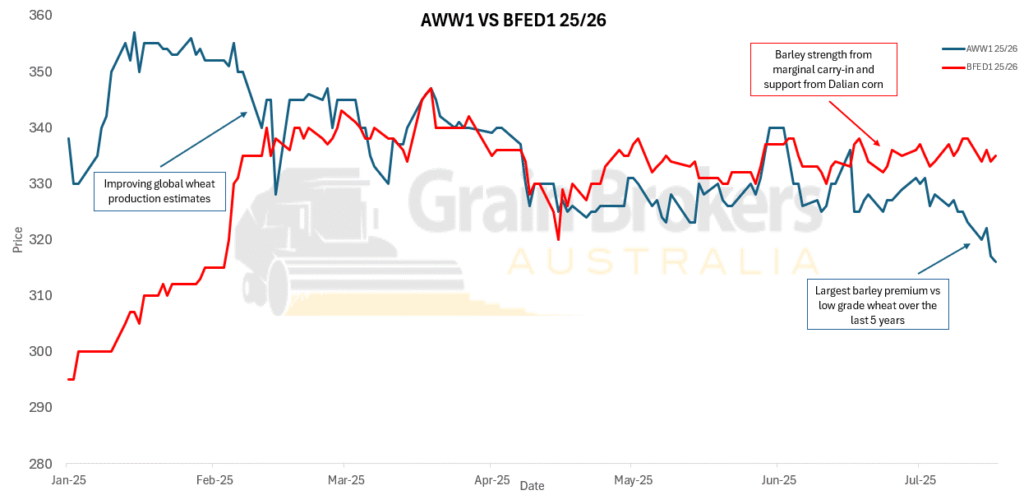

With WA old crop supplies now cleared out and new season production ramping up, there are several key factors shaping the 2025/26 barley market outlook.

- Barley values have held firm at $330–$340/t over the past two months, supported by tight old crop stocks and steady Chinese demand.

- Production risk is easing, with increased hectares and solid rainfall improving yield outlooks across WA.

- Buy-side demand is limited, with only two buyers active in the short term — creating potential price risk if supply momentum builds.

- Low-protein wheat is dragging barley sentiment lower, as buyers look to substitute with cheaper feed wheat.

- Currency volatility is adding noise, with recent swings in the AUD moving prices around unexpectedly.

- Global feed grain pressure is building, with a large US corn crop likely to offset any support from EU drought concerns.

💡 What does this mean for you?

If you’re light on forward cover, now is a smart time to look at new crop barley sales. With wheat values underperforming and harvest costs approaching, barley could be your best option for early cashflow.